Export Of Electronics, Communication, And Information Technology

If you need to import or export IT or telecommunications equipment from the Netherlands, you should know that different industries have different shipping requirements. Some things to take in mind while sending information technology and telecommunications gear to the technological, medical, automotive, and aviation sectors in the Netherlands are as follows:

Tech Industry

It is crucial to familiarize oneself with local rules and get the necessary certifications before importing IT and telecom equipment. Specific certificates and norms are required for imports to run without a hitch. The timely delivery of your IT and telecom equipment depends on the Importer of Record (IOR) competence.

The complicated regulatory framework in the Netherlands might make it difficult for enterprises to import IT and communications equipment. Local certificates, assurances of product safety, and taxes and customs must all be considered by business owners when importing items. To ensure compatibility with international standards, it is also essential to consider trade regulations.

Aviation Industry

Safety regulations for the aviation sector in the Netherlands also apply to the import of computer hardware and software. Airworthiness certificates are required for some items, which calls for extensive testing and inspections. We have coordinated with aviation regulators to achieve timely, cost-effective approvals and certifications.

Predictive maintenance is gaining traction in the aviation sector. With data analytics and models of previous breakdowns, predictive maintenance can repair equipment before it breaks down. Therefore, the necessity for cutting-edge testing equipment that can back up preventative maintenance plans is growing.

Medical Industry

Knowledge of medical device legislation and standards is necessary to ship IT and telecom equipment to the healthcare sector. Ensuring your items are appropriately labeled and packed per healthcare rules set out by organizations like the Central Organisation for Standardisation and Quality Control (COSQC) and the Ministry of Health is essential.

Automotive Industry

Designing and testing the hundreds of components needed in automobile manufacturing might be expensive and time-consuming. Because of the money and time it may save, digital twin technology is invaluable.

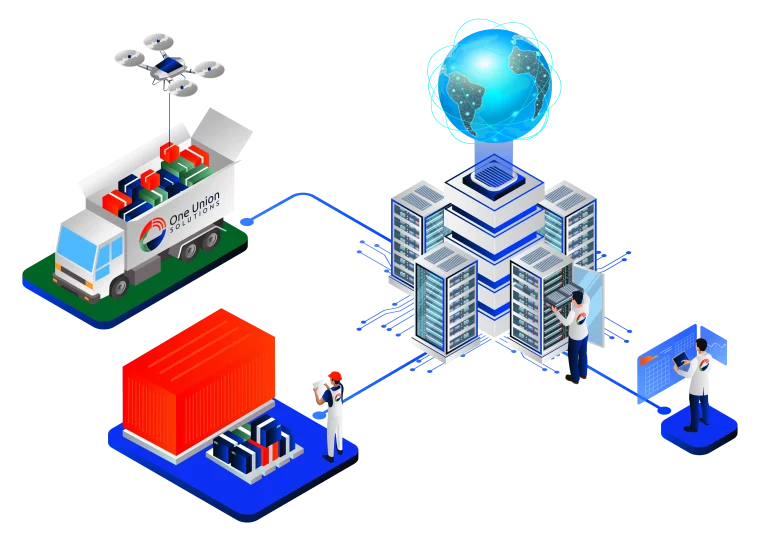

Our professionals have extensive knowledge of the norms and standards in technology, medicine, automotive, and aviation. They will ensure that your imports are both safe and up to par. Your packages will arrive on time since we operate worldwide and provide dependable shipping services.