Global Importer of Record Services

Whether you need to outfit a new office abroad or move to a data center, we’ve got your back. The global Importer of record service we offer guarantees the first-time customs clearance of your tech hardware to over 170+ destinations. When dealing with customs authorities, One Union Solutions are at your service to advise you on the tariffs, import duties, trade agreements, and any other global trade-related issues.

Why is an importer of record (IOR) significant, and what does it mean?

The person in charge of importation is known as the Importer of Record (IOR). Legal responsibility for paying duties, taxes, and fees rests with the importer. The importer also has to abide by all laws and rules pertaining to imports, especially those pertaining to customs. The person buying or receiving the imported goods, or any interested party with the authority to facilitate entry under the purview of the applicable customs regulator, can be considered the importer.

When Does an Importer of Record Need to Be Selected?

It is obligatory to have an Importer of Record present at any time products are brought to a country from another country. One of the responsibilities of the Importer of Record is to ensure that the necessary documents are duly filled and further specifications of the countries of origin of products, their cost, or applicable taxes and tariffs are passed on.

Along with the licenses and permits for the specific items, they become obligatory. Some of the goods may be perishable or difficult to import, for which importers may need to apply for special permits. Though, you should bear in mind that the need, or what type of Importer of Record will be necessary, depends on the exact item and the country it is destined to. For instance, some states can attribute an Importer of Record to be a citizen or a company situated there.

If you are not certified as to whether you need an Importer of Record for your unforeseen import operation, seek a customs specialist or other specialist who may help you navigate the complicated guidelines that apply when importing products.

What are the Importer of Record's Responsibilities?

When dealing with any kind of transportation where the Importer of Record (IOR) is involved, several key tasks are included. A pivotal role is keeping track of the submission of all the required forms to the pertinent regulators. Such transparency occurs through a display of the product’s countries of origin, the cost, and the taxes and tariffs.

Beyond the document organization, IORs are also required to make sure the delivered products conform to the rules and regulations of the destination country. This would mean certifying that safety standards, labeling requirements, and any other applicable legislation representing the legal status of the place of destination are being followed.

The job of an Importer of Record (IOR) involves carrying out various important tasks in the process of bringing goods into a country.

Documentation

Providing for the correct and timely submission of all required import documents. The technical side encompasses the supply of classification information about the goods, like their country of origin, worth, and nomenclature of Harmonized System (HS) code.

Customs Compliance

Adjust customs rules and regulations of the destination country. This implies entering specific areas of obligations related to duties, taxes, and restrictions or prohibitions on some goods.

Tariff Classification

Properly classify the imported goods, identify their Harmonized System code, and determine the appropriate duties and taxes.

Payment of Duties and Taxes

In charge of paying import duties, taxes, and any fees involved in the release of the goods by the customs department.

Quality and Safety Compliance

Before allowing the imported products into the market, make sure that all these safety standards, labeling requirements, and other regulations of the destination country are met.

Record Keeping

Keep a proper record of all imported goods and importation-related documents. This is essential for audit purposes as well as it may be required by customs authority.

Communication with Customs Authorities

As the intermediary between the enterprise and the customs department, counter the bearing that the questions might have and provide the needed information.

Product Compliance

Make sure that what you are importing respects any special rules or certifications which the country of destination demands.

Importer Security Filing (ISF)

Complete the Importer Security Filing (ISF) in accordance with the "10+2" requirement, which is an advanced information filing to US Customs and Border Protection (CBP) in the USA.

However, the nature of these duties will basically be in line with the specified rules and regulations of the destination country as well as the peculiar characteristics of the imported goods. The Importer of Record (IOR) performs a vital function of ensuring that the goods are transported in a seamless and legitimate manner between jurisdictions.

Compliance and Seamless Delivery from Start to Finish

Complete Customs-to-Delivery Import Solutions with Us

One Union Solutions, takes upon its shoulders the responsibility of dispatching the consignment to the final consignee that will go through the customs clearance.

Let us help you with these things:

- Establish efficient import services across the globe.

- Transport products to your market target.

- Ensure business-critical stock levels in a particular country.

- Provide hassle-free customs clearance

- Cover all the required fees and taxes.

- Secure all the necessary permissions including licenses and authorizations.

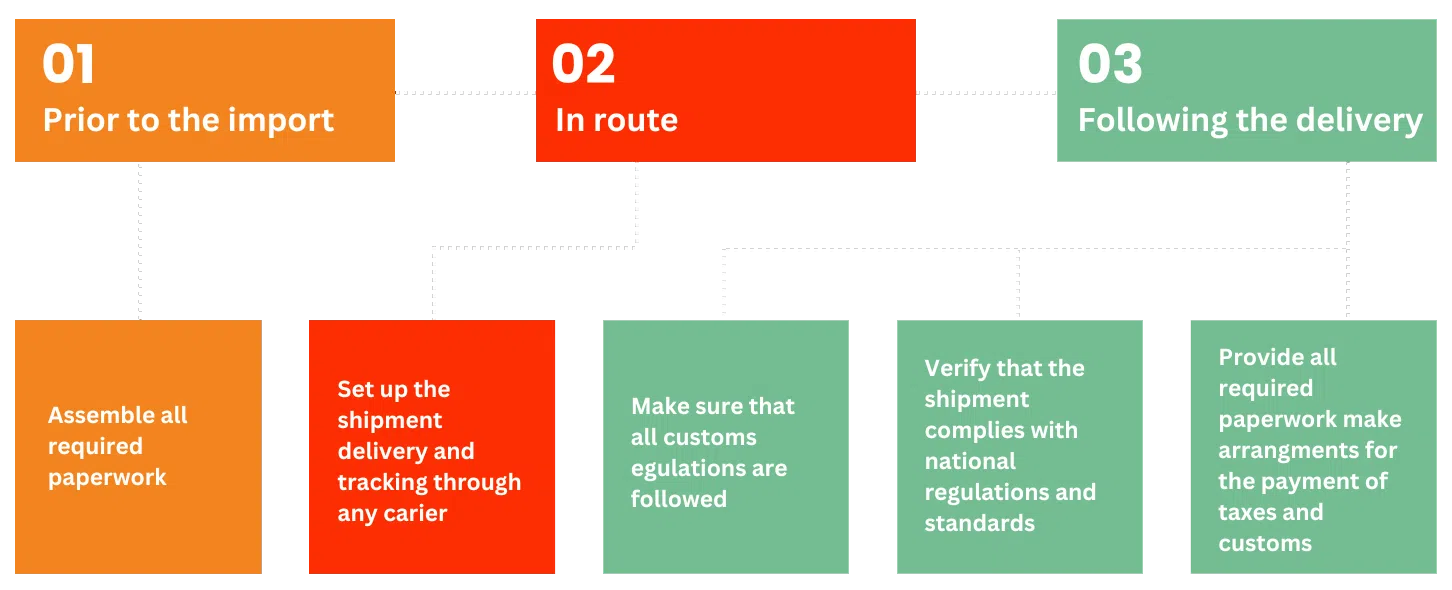

Here is how the Importer of Record process works

We screen your product for import and determine the regulatory requisites as well as the import/tax fees towards bringing in your product.

We do all the paperwork and acquire the necessary permits to let the shipment into the country of destination.

One Union Solutions as our legal importer, get the shipment imported through customs by our Import and Export (IOR) department.

We provide legal protection for the shipment and facilitate other parts of the import process, for example, payment of taxes and coordination of the final delivery.

What distinguishes One Union Solutions from the rest?

With One Union Solutions’ IOR services, shipping to other nations is hassle-free and doesn’t require the worry of compliance and legal issues or the establishment of a legal entity in the destination country. By handling everything, our staff ensures efficient procedures and reduces the possibility of delays, penalties, or other issues.

Industry Experts

Our team of professionals has the expertise that is needed in order to understand the complex rules and conditions imposed by various jurisdictions. We always keep tabs on any changes and cooperate closely with the authorities in order to be in line with the regulations.

Saving Time and money

One Union Solutions IOR features include import flow standardization, which makes the import process run smoothly and seamlessly. Legal issues will be dealt with by our team on your behalf, which means they will be saving your company precious time and resources.

One Union Solutions is your IOR Partner

From the biggest OEM to smaller businesses, we have experience working throughout the whole IT supply chain. Our extensive experience in compliance and our Importer of Record solution guarantee that we can successfully clear customs the first time around for your IT hardware. Import compliance is made simple with IOR services from One Union Solutions.

Ship your tech hardware around the globe with OUS today.

Frequently Asked Questions

Most of the time, especially when the IOR is acting as a third party-declarant, they take temporary ownership of the imported goods. This implies that they will assume ownership of the goods from the point of origin to the point of import. They will take on every responsibility expected of an IOR. Ownership of the goods will pass from the designated IOR to the new owner upon transfer to their final destination. The permanent owners of the goods may also be the importer of record. This usually happens when private companies shipping goods decide to handle every step of the importation process independently. The final owner of the goods must, however, be certain that they comprehend all requirements if they wish to assume the role of importer of record.

Factors such as the nature of the shipping, the regulations of the destination country, and the level of proficiency and experience of the parties involved, will determine whether you select an Importer of Record and a consignee. For instance, you may wish to go for an Import of Record if it is your first time to import goods into a new country or you are not conversant with the customs clearance process in the respective destination country.

An Importer of Record with the relevant experience can assist you in getting the required paperwork done accurately and within the deadline and pay any applicable taxes or duties. On the other hand, if you are well aware of the procedure of customs clearance in the destination country and feel comfortable with documentation and payment of taxes and duties, a consignee might be a more suitable choice.

With the consignee, goods are received and inspected when they arrive and, if necessary, any problems or damages are sorted out quickly. All in all, the choice between an Importer of Record and a Consignee will be based on your individual requirements. Partnership with a customs broker or a specialist like One Union Solutions will greatly improve your ability to make an intelligent choice in importing and ensuring successful operation.

If you are keeping a third-party logistics company as your appointed importer of record, they will temporarily own the goods as long as they perform this function. When the goods finally reach their intended destination and are safely in the hands of the individuals, either for their use or for resale, the ownership of the goods is then assumed by the owner who is no longer the third party.

In case the importer of record drops out before the importation procedure has finished, it will be the cause of delays until the new importer of record is assigned and assumes ownership of the relevant goods. Hence, employing a trustworthy importer of record for the country where your goods are received is suggested.

The importer of record is the buyer, consignee, or owner of imported goods at importation. As IOR, a licensed Customs broker authorized by the owner, purchaser, or consignee can make entry. IORs can be individuals or entities.

Owners and Purchasers: Any financial stakeholder in imported goods is an owner or buyer. They may be the owner, buyer, agent, or consignor. An owner or purchaser can enter themselves or designate a licensed Customs broker as the Importer of Record.

Customs Brokers: A Customs broker needs Power of Attorney (POA) to clear an importer as the Importer of Record. The importer is responsible for sending CBP accurate documentation and paying all duties, taxes, and fees, even if they use a broker.

Entities: An entity is a businessable person, group, corporation, partnership, etc. An entity can be the Importer of Record if it buys imported goods.

Consignees: In some cases, the buyer owns the goods being imported but consigns them to a consignee to enter the US as the Importer of Record. So, the buyer trusts the consignee to handle other logistics and customs entry. Entrustment is consignment legally. After the goods are entered, the buyer will take full ownership.

Sellers: The seller may be the Importer of Record if they own the goods upon importation. Customers who don’t own the goods until delivery don’t own them at entry. If so, only the seller, the owner at entry, can be the IOR.

Pages

Services

Subscribe to our newsletter

- Copyright © 2024

- One Union Solutions

- All Rights Reserved

Any questions?