Experience with Customized Answers

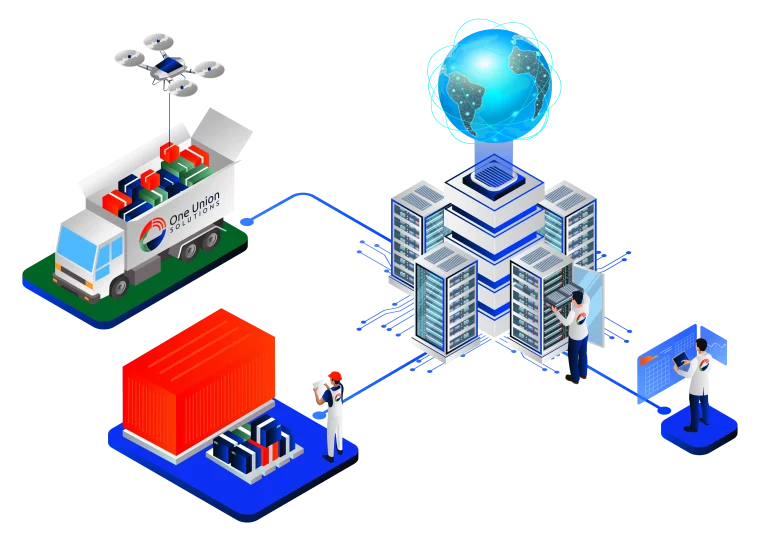

One Union Solutions recognizes the individuality of each company. We take an individualized approach, tailoring our services to meet your requirements while being adaptable to accommodate any changes in your organization.

Sending Electronics to Israel’s Many Businesses

Understanding the specific needs of each market you serve is essential as an exporter and importer of IT and telecom equipment in Israel. Insights on the challenges of transporting IT and telecom equipment to Israel’s technology, healthcare, automotive, and aviation sectors are provided below.

Tech Industry

Increases in manufacturing efficiency brought about by technical advancements allow for higher-quality products and services. By staying current, manufacturers may capitalize on emerging markets and innovative concepts. Companies that adopt innovative practices may find new ways to decrease costs, boost output, and present themselves as progressive.

Our staff has vast experience dealing with various things, including IT hardware and software, machinery, textiles, and spare parts. If you have One Union Solutions handle Customs clearance, you can be confident that your packages will swiftly get where they’re going.

Aviation Industry

IT and telecom equipment must conform to stringent government regulations when supplying the aviation sector. Included in this is adhering to all rules set out by the MOCA. The Israel aviation sector must consider the technical specifications of imported equipment. Compatibility with current systems and resilience to severe environments are two examples of such criteria.

Automotive Industry

The automotive industry is subject to some regulations and rules. Knowing the unique criteria of the automobile sector, such as the automobile sector Standards (AIS), is essential for adhering to Israel’s import and export laws from the Automotive Research Association of Israel (ARAI).

Many different types of items are shipped in the aviation sector. Logistics and transportation services ensure that things reach their destination individually. The Israel Civil Aviation Authority has established rigorous rules and standards for air cargo carriers’ safe and secure operation.

Medical Industry

Medical devices and equipment must adhere to various regulations, certifications, and compliance criteria. Medical device manufacturers need insight into the industry’s future to make strategic investments in light of growing costs, shrinking hospital budgets, and general market uncertainty.