Simplifying International Trade

Learning about the laws and regulations surrounding global transactions is of utmost importance for importers & exporters in transnational commerce. One framework that guides these exchanges is Incoterms (International Commercial Terms). These phrases detail buyers’ & sellers’ responsibilities while dispelling misconceptions related to multinational trade.

From well-known words like DDP Incoterms and DAP Incoterms to Incoterms 2020–2024, this post will walk you through the complex world of Incoterms. Businesses involved with international commerce will benefit greatly from understanding these terms; knowing them enables wise choices, reduces problems, and helps run functions more smoothly.

For businesses involved in cross-border transactions, it is essential to have a clear understanding of how Incoterms work in international trade. In short, they guide the commercial terms when dealing with foreign exchanges and help both parties to know their obligations, thus making operations conducted smoother and misunderstanding almost negligible. In this way, a company can save time, money, and concern to avoid potential disputes and improve supply chain management worldwide. Incorporating Incoterms into contracts is an effective way for businesses to simplify their operations and enhance efficiency.

What Are Incoterms?

Incoterms are internationally recognized laws that specify customers’ & agents’ duties under sales contracts for commodities being supplied under Incoterms contracts. Established by The International Chamber of Commerce in 1936, these terms have since been modified for various firms internationally.

Incoterms provide an ideal language for exporters, importers, freight forwarders, and transportation to communicate. Each Incoterm represents delivery points, cost duties for freight transportation costs, insurance tariffs & risk privilege during transit – making multinational commerce simpler by creating an international standard language between them all.

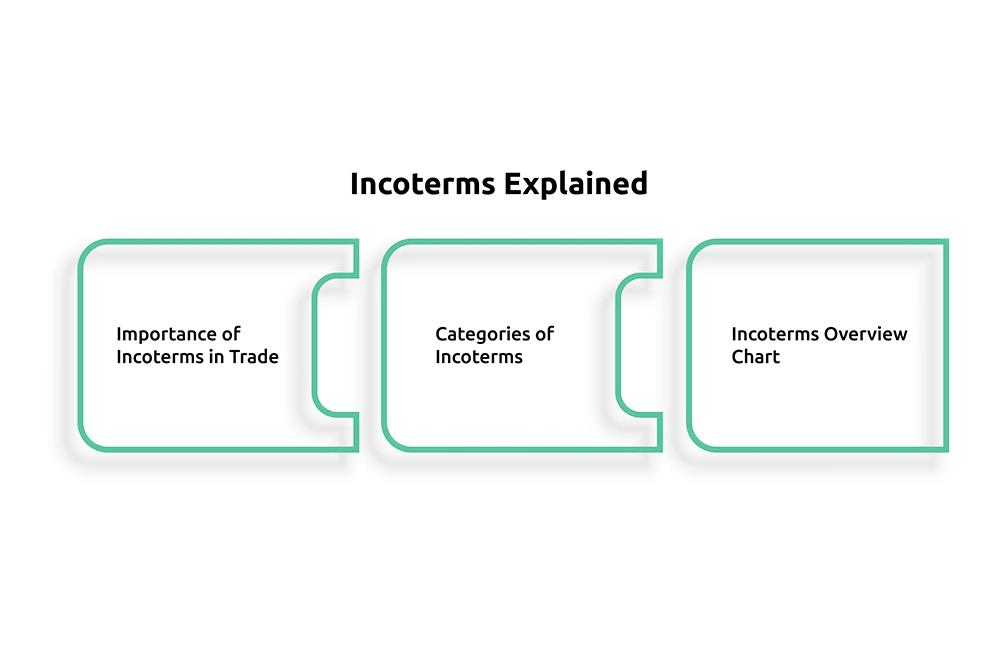

Incoterms’ Importance in International Trade

Understanding Incoterms is crucial for the importer for several reasons:

Transparency of Duties: Incoterms ensure that all parties are aware of their responsibilities by defining duties in international custom. Effective carrier management, insurance planning, and knowing when to take on cargo are critical for imports.

Cost Efficiency: By selecting the appropriate Incoterm to distribute expenses fairly, importers can achieve cost efficiency. Negotiating favorable conditions helps them avoid unforeseen costs and fits with their business strategy.

Risk Reduction: Managing issues in international trade requires knowing the appropriate Incoterm for a transaction. Various words influence insurance coverage and responsibility during transportation by defining when duty switches between importer and exporter.

Know Key Incoterms:

Based on Incoterms 2020 standards, eleven Incoterms have been classified based on various modes of transportation. We will cover some of them below.

EXW or Ex Works

The 11 terms in the Incoterms 2020 criteria are grouped according to ways of transportation to specify the duties of buyers & sellers in international trade. EXW is one of the most used terminologies, where the seller makes the equipment available at the location or prearranged spot. After that, the buyer is solely accountable for paying for all risks & expenses related to insurance, customs charges, and transportation. Only making the goods available is the seller’s responsibility; the buyer accepts all other risks and logistics.

FOB/Free On Board

Free On Board-FOB is used for sea or inland waterway transport and under FOB the seller is liable for the costs & the perilous association with transporting the equipment to the port of shipment. Once the equipment is loaded to the ship, the responsibility moves to the buyer, who takes care of all costs & risks from that point onward. The seller’s job concludes when the goods are safely loaded onto the ship, and the buyer takes over from there.

CIF: Cost, Insurance, and Freight Incoterms analysis

CIF stands for Cost, Insurance & Freight & requires the seller to cover transport, insurance and freight to bring equipment directly to its destination port. However, unlike FOB, where risk passes after goods are loaded onto a ship, under CIF, the seller assumes full responsibility for transportation & insurance costs up until arrival at the destination port. At the same time, FOB transfers this risk upon loading onto the ship – with risk passing to the buyer upon loading onto the vessel.

Delivered Duty Paid Incoterms/ DDP

DDP provides buyers with maximum convenience as the seller assumes all costs and risks associated with transport, customs clearance, and taxes before delivery to the buyer’s location. Furthermore, no expenses or liabilities for delivery will fall on them, giving complete peace of mind to these terms as buyers don’t need to deal with logistical details themselves.

DAP/Delivered at Place

Delivered at Place service specifies that the seller is responsible for covering transportation costs & troubles until the equipment reaches an appointed destination; the seller takes care of the delivery & the fixed hazards; the buyer is liable for paying any customs duties & taxes on the arrival of the equipment. The seller’s obligation ends when the equipment reaches the specified location; & buyer takes over the responsibility for final clearance & payment of duties.

Incoterms | Logistics Guide

Incoterms play a strong role in logistics determining who’s responsible during the transport of goods. These terms are extremely useful in complex global supply chains where equipment passes via multiple borderlands, making it critical to understand who is responsible for customs clearances, taxes, & delivery.

For example, suppose a company in the U.S. sells equipment to a customer in Germany, in that case, the agreed Incoterm will dictate whether the seller or the buyer is responsible for handling the shipment, insurance, and taxes.

How Incoterms Benefit The Business?

Using Incoterms correctly can offer significant benefits to your business by saving time, and money, & reducing legal risks. First, they provide cost clarity by clearly defining who is responsible for various aspects of the transaction, preventing unexpected expenses from arising. They also help with risk management by specifying exactly when the risk of loss or damage shifts from the seller to the buyer, allowing both parties to plan and protect their interests. Additionally, by using standardized terms, Incoterms simplify contracts, making transactions smoother, more predictable, and easier to manage, which ultimately reduces complexity and potential misunderstandings.

Did You Know

The World Bank 2020 Report states, over $23 trillion worth of goods are traded globally each year.

Conclusion

Incoterms are important mechanisms for managing international trade & logistics. By comprehending these rules, businesses may reduce risks, maintain clarity in their contractual obligations, & guarantee smooth economic transactions. Whether you import or export equipment, understanding Incoterms will be required for your success in international trading. At One Union Solutions, our mission is to help your business overcome the obstacles of international shipping so you can make the best choices for your logistics operations.

FAQ’s

- What does EXW refer in Incoterms?

Ans: An ‘ex works’ delivery means the seller makes the goods available at the premises or another location with the buyer taking on responsibility for transportation, customs duties, & the insurance costs.

- Which Incoterm should sellers select as their trade terms of preference?

Ans: For sellers seeking to minimize the responsibility, the EXW can often be the optimal option, placing all responsibility squarely on the buyer.

- How do the Incoterms affect cost of shipping?

Ans: Incoterms specifies who’s responsible for shipment, insurance, and customs fees, have a direct effect on the overall cost of shipping for both parties.

- Can I include more Incoterm than one in a single contract?

Ans: Indeed! Different Incoterms may be specified in some contracts for various aspects of a transaction involving several different forms of transportation.

- How do DAP & DDP different?

Ans: The seller pays for shipping under DAP but the buyer is responsible for paying customs fees & taxes. However, the seller bears all expenses including taxes and customs charges with DDP.