Insight

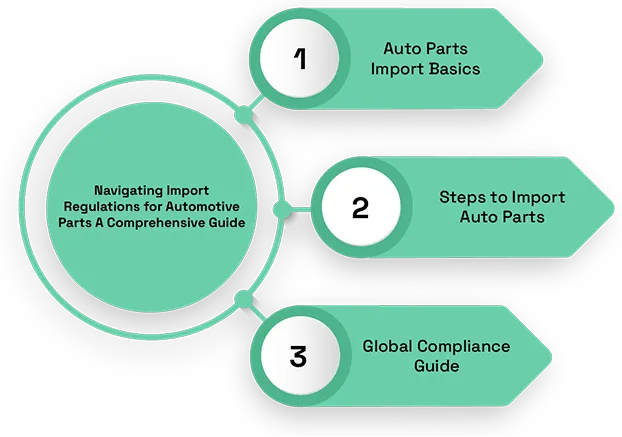

The complex nature of automotive part imports occurs because different nations apply distinct regulations for Compliance. Automotive parts are the main components for vehicle manufacturing and maintenance, while vehicle repair activities require businesses in this sector to have complete knowledge of import regulations. Compliance with import regulations helps all automotive businesses achieve updated processes and efficient operations while avoiding expensive delays. This detailed guide will explain key steps associated with import regulations for automotive parts, covering essential points like documentation requirements and standard compliance and customs handling procedures.

Understanding Import Regulations for Automotive Parts

Understanding the regulatory framework of the importing destination constitutes the initial step in importing automotive components. All countries establish particular requirements that regulate the importation of automotive parts and other equipment. These regulations protect the country’s safety, environmental protection, and manufacturing standards.

Most importers have to follow customs regulations and import laws of the destination country while often facing limits on specific automotive parts ranges like security components, exhaust systems, and specialized units. Knowing which precise regulations govern the imported parts you handle will help bypass unnecessary delays that could result in penalization.

Key Documentation for Importing Automotive Parts

Automotive parts import requires proper documentation to follow customs regulations successfully. Commercial invoices present transaction details, but the bill of lading demonstrates proof of shipment together with origin and destination information, and import declarations show goods alongside their values and applicable tariff classifications. The certificate of origin is necessary to establish part origin when seeking preferential tariffs. Compliance certificates for safety and environmental standards might be necessary to validate that the parts meet all criteria. Inadequate documentation or mistakes in shipping documents lead to delayed shipments, possible fines, and confiscation of goods.

Classification and Tariff Codes

The correct classification of automotive equipment is essential for importing these components because it determines their tariff codes. A unique code must be assigned to each imported item because these codes determine the correct amount of duty and tax when entering goods into the country. The incorrect classification of goods causes both excessive and inadequate duty payments and creates possibilities of penalties and delays.

Most importing nations employ the standardized HS codes to classify their products through the Harmonized System nomenclature. Automotive parts must receive accurate classification to operate properly. Understanding the nature of the parts determines their classification between finished components, raw materials, and replacement parts because each category leads to different tariff rates.

Compliance with Safety and Environmental Standards

Countries implement rigorous safety standards together with environmental standards for automotive parts to guarantee their safety and environmental friendliness. Safety standards need testing to validate parts’ performance, including airbags, seat belts, and brakes. Environmental standards affect exhaust systems and catalytic converters by implementing tests regarding their emissions performance and energy efficiency. Non-compliance will result in entry denial and financial penalties. Every entry or exit requires evidence through certifications demonstrating testing outcomes for regulatory compliance.

Customs Procedures and Duties

The customs authorities handle the import after receiving all mandatory documents required for processing. Countries follow different customs techniques, usually involving officers checking documents before classifying merchandise and determining import taxes and duty rates.

The value of goods determines import duties and taxes since it includes parts costs, freight expenses, and insurance costs. Several countries offer free trade agreements with specific tariff programs that eliminate duties when specific conditions are met.

Verify whether your imported automotive parts qualify under existing free trade agreements because qualification enables you to obtain reduced or waived import duties upon proper paperwork submission. The goods will stay at customs until the customs compliance problem gets resolved when manufacturers ignore procedures or do not pay full customs duties.

The Role of Customs Brokers

Customs brokers understand all aspects of import regulations because they specialize in their complexities. As professional intermediaries, Customs brokers bridge relationships between importers and customs authorities to verify accurate documentation while ensuring regulatory compliance with imported goods. A customs broker becomes a critical choice for numerous businesses when handling the import process, particularly when handling complex or expensive automotive parts. Combining knowledge of tariff codes, regulatory practice, & importing details regarding specific goods allows customs brokers to assist businesses through their import operations efficiently.

The Importance of Staying Updated on Regulations

Regulatory changes affecting automotive part imports should be monitored by businesses in order to maintain operational effectiveness. The import process faces potential alterations due to variations in international trade agreements, changes in tariffs, safety standards, and environmental regulations. All businesses participating in automotive part importation must regularly monitor regulatory modifications and adjust their business procedures accordingly.

Businesses can stay updated by joining trade & industry newsletters, spending time at conferences, and establishing communication with trade associations and government bodies specializing in international trade regulations. A partnership with logistics providers who understand customs regulations and regularly read trade and industry news will ensure your business meets all current laws.

Conclusion

The process of importing automotive parts needs thorough attention regarding documentation, alongside specific knowledge of classification systems and established compliance standards. The key to avoiding delays and penalties is ensuring your products satisfy all necessary safety, environmental, and regulatory demands. Businesses succeeding in their import procedures can direct more efforts to operational expansion with the help of regulatory experts while keeping updated about recent regulations. One Union Solutions works hard to assist businesses through regulatory intricacies & enhance their trading operations for better compliance and efficiency results.

Did You Know,

The World Trade Organization statistics reveal that automotive parts trade exceeded $1 trillion in 2022 after showing substantial expansion in emerging market sectors.

FAQs

1. Which documents are needed for importing automotive parts?

Importing automotive parts requires multiple documents that depend on specific part types. The required set includes a commercial invoice, a bill of lading, an import declaration, a certificate of origin, and canary compliance certificates.

2. How should I classify automotive parts before importing them?

All automotive parts need proper classification under the Harmonized System (HS) for tariff code assignment. The process of correct classification guarantees that suitable import duties, together with applicable taxes, are properly assessed.

3. What are the environmental regulatory requirements that apply to automotive parts?

Global regulations mandate environmental compliance testing to verify that exhaust systems and catalytic converter production meet emission requirements.

4. Are there any possibilities to lower the tariffs applied to automotive parts when importing?

Parts that fall under the scope of a free trade agreement (FTA) and tariff programs may receive either full duty exemptions or reduced duty rates. A customs broker can evaluate your goods for qualification when you contact them.

5. What methods exist to track down changes in import rules?

You can stay updated on import regulations by reading trade newsletters while organizing consultations with customs brokers or logistics experts focusing on international trade and joining appropriate industry associations.