The Tech Industry: A Booming Sector in Peru

Understanding the Regulatory Environment

The tech sector in Peru is rapidly expanding, offering ample opportunities for businesses. However, navigating the regulatory environment can be challenging. Firms in the tech industry must ensure compliance with local laws, including data protection and intellectual property regulations.

Import Duties and Taxation

For businesses looking to import technology products into Peru, understanding import duties and taxation is essential. These costs can significantly impact the bottom line. It’s crucial to work with experienced customs brokers like One Union Solutions who are well-versed in the intricacies of Peruvian tax laws.

Medical Equipment: A Vital Industry

Certification and Regulatory Compliance

The medical industry is highly regulated worldwide, and Peru is no exception. To succeed in this sector, companies must obtain the necessary certifications, such as Good Manufacturing Practices (GMP) and ISO standards. Compliance with Peruvian health regulations is non-negotiable.

Trade Agreements and Partnerships

Peru has established trade agreements with various countries. Understanding these agreements and how they affect the import and export of medical equipment is crucial for businesses operating in this sector.

Automotive Trade: Driving Opportunities and Challenges

Tariffs and Import Duties

Importing automotive products into Peru can be a lucrative venture, but it comes with its share of challenges. Understanding the tariff structure and import duties is essential. Firms must also be aware of regional differences in regulations.

Sustainable Practices

Peru has been increasingly focusing on sustainability in the automotive sector. Businesses looking to thrive should incorporate sustainable practices into their operations, considering the growing demand for eco-friendly vehicles.

Aviation Industry: Reaching New Heights

Safety and Regulatory Compliance

The aviation industry demands strict adherence to safety and regulatory standards. In Peru, the Directorate General of Civil Aviation (DGAC) plays a pivotal role in ensuring safety. Airlines and aviation-related businesses must comply with DGAC regulations.

Aeronautical Certifications

For aviation companies, obtaining aeronautical certifications is paramount. These certifications attest to the safety and reliability of aircraft and related equipment. They are essential for both domestic and international operations.

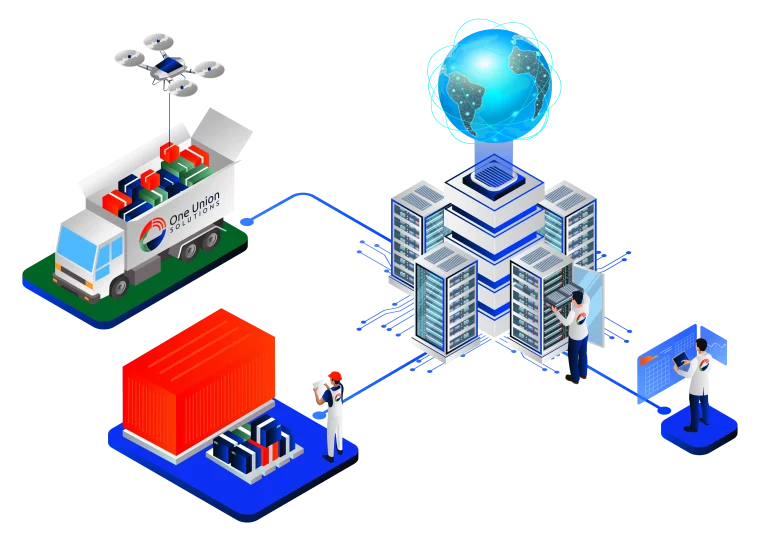

Streamline IT and telecom equipment with our DDP solutions

One Union Solutions, a distinguished provider of IOR and Trade Compliance Solutions across various industries, encompassing technology, medical, Automotive, and aviation, offers a strategic gateway to navigate the complex landscape of international trade in Peru. Our unwavering commitment to excellence and specialized knowledge has solidified our position as a prominent entity in the global market.

In our capacity as experts in Global IOR and Trade Compliance, we deliver a comprehensive suite of services, which includes Importer of Record (IOR), Exporter of Record (EOR), DDP Delivery Service, and White Glove Delivery Service. These services extend to clients operating in over 170 countries worldwide. Our team of seasoned professionals remains accessible around the clock, equipped to provide invaluable guidance and innovative solutions, ensuring seamless adherence to Peruvian trade regulations.