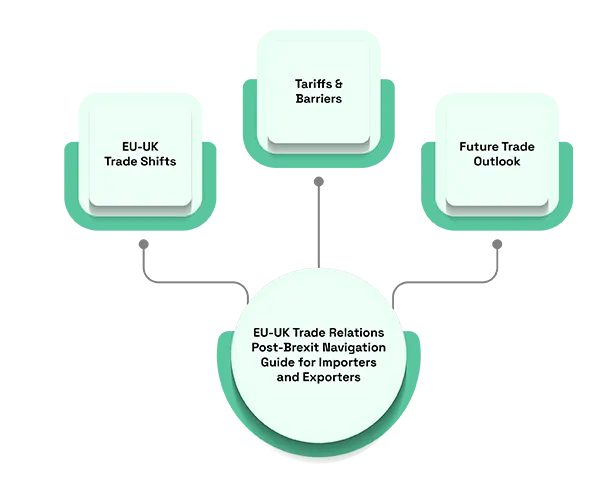

Insight

Brexit represented a huge change to the trading agreements between the UK and the EU, and businesses on both sides of the Channel have been forced to adjust to a new reality. For importers & exporters navigating this new framework is paramount. Despite the numerous remaining constants in trade, several developments pose challenges that businesses must find ways to meet head-on.

The Changing Trade Landscape

As a result of the UK leaving the EU, there are now new guidelines for imports, such as customs checks, paying tariffs, and meeting regulations. The era of free movement for various goods is now over. Nowadays, companies must tackle various new customs regulations, forms, and taxes to move their goods to or from the UK.

While the Brexit deal allows businesses to trade goods without paying tariffs, it doesn’t remove the global trade challenges. Since the UK has left the EU’s Single Market and Customs Union, importers and exporters will encounter a more challenging process.

Tackling Customs and Tariffs

Businesses are seeing the biggest shift post-Brexit in the form of new customs requirements. Although the UK & EU agreed there will be no tariffs on most goods, this only covers those that meet the “rules of origin.” You can only trade goods duty-free if they were created in the UK or the EU. Therefore, companies should ensure they have proper paperwork verifying where the goods came from. If they do not do this, they may have to pay more.

Any business trading with the UK must declare its goods through customs. Information here includes a description, the category, & the estimated value of the goods businesses send to customs. A company may experience delays or incur heavy fines if it fails to have correct and up-to-date documents.

Logistics: A New Challenge

Logistics & transportation are also feeling the effects of the Brexit decision. The delay in customs is causing UK goods bound for the EU to take longer to ship. This means companies may run into postal delays, leading to higher costs for paperwork.

Some companies rely on dependable deliveries, and the pandemic has complicated this issue. Businesses should look at their supply chains & prepare for any possible delays. After Brexit, businesses should ensure they are paired with logistics suppliers who can help manage the new rules.

VAT and Taxes: Navigating the New Rules

The UK and EU followed the same VAT system before Brexit, allowing businesses to transport goods easily without tax worries. Since each country now sets VAT, companies must get used to the new rules for each one.

UK companies now need to pay VAT on goods they import from the EU, and the same applies to goods from the UK purchased in the EU. As a result, companies importing goods might have to handle VAT during import. The new system is difficult for these companies because they used to move goods before applying VAT.

On top of everything, companies have to register for VAT and file VAT reports in both regions. You might need to work on extra paperwork; there will be more administrative duties and, in certain situations, VAT is paid immediately instead of waiting for reimbursement.

The New World of Import/Export Documentation

Any goods transported across the UK & EU border must now be accompanied by extra documents. Companies should ensure they are careful when filing the required documents with customs. It is important to confirm that every document, for example, the customs declaration, the certificate of origin & the invoice, is complete before handling the import or export.

If your documents are incorrect, there could be delays at the border, leading to rising costs and losses. For this reason, companies should work hard to address all the latest demands. The process can be made simpler by hiring trained customs brokers or freight forwarders handling trade between the UK and the EU.

How Does This Impact Importers and Exporters?

Brexit has introduced new problems for businesses that trade with Europe through Britain. However, there are some areas where Africa is making progress. While tariffs are lifted for many goods, the new procedures at the border have made businesses question their current activities. Companies must keep up with new regulations, including origin rules, correct customs declarations, paperwork, and VAT.

Businesses should also put effort into finding logistics partners they can rely on for help with issues associated with trading internationally. There’s more to Brexit than moving goods; you must be aware of the entire trade process from customs to transportation to VAT checks.

Although Brexit has caused more difficulty in UK-EU business trade, businesses can adjust and seek new ways to maintain efficiency.

Conclusion

After Brexit, careful handling of customs, VAT, and shipping is necessary. Ultimately, companies that pay attention and make changes will keep doing well amid the new trade rules. At One Union Solutions, we ensure that your import and export processes are simple and compliant with all regulations.

Did You Know,

After Brexit, the UK saw a 15% drop in exports to the EU in the year that followed. Although the growth of exports to other EU countries was just over 1%, businesses saw a nearly 8% rise in exports to countries outside the EU.

FAQs

What are the biggest import-export challenges for UK businesses post-Brexit?

Customs declarations, the introduction of new tariffs, and VAT obligations have presented businesses with their greatest challenges yet, and they are now facing multiple regulatory systems.

How can companies ensure their products are eligible for tariff-free trade between the UK & the EU?

Businesses must satisfy “rules of origin” criteria to prove their goods have been made or at least processed in the UK or EU.

How has UK VAT changed following Brexit?

VAT is now in force on trade between the UK and the EU, which requires businesses to pay this tax when importing and have new registration and reporting obligations.

What documents will I need to import and export between the UK and the EU?

Businesses must submit customs declarations, proof of origin, bills of lading, and, for some goods, certificates of compliance.

How could businesses avoid getting stuck at the border?

Companies can check the box for the European Union’s customs union. Still, they must also ensure paperwork is accurate, rely on experienced customs brokers, and be ready for extra checks that can slow things down at the border.